epf withdrawal i sinar

However it is important to note that this is not a withdrawal. The Employees Provident Fund EPF is in the process of lifting several conditions for the i-Sinar withdrawal facility which among others will allow contributors under the age of 55 to withdraw from their Account 1 funds.

Epf Account 1 Withdrawal I Sinar The Pros And Cons

The removal of conditions will allow EPF members under the age of 55 to withdraw from their Account 1 funds subject to their existing balance Tengku Zafrul said in a statement today.

. The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1. According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. He said for members who had already applied for i-Sinar under the current criteria their applications would be automatically approved in due course.

The level of savings of Employees Provident Fund EPF members is low and very worrying especially after the implementation of four withdrawal facilities related to Covid-19 namely i-Lestari i-Sinar i-Citra as well as the special one-off withdrawal of RM10000 said Deputy Finance Minister I Datuk Mohd Shahar Abdullah. Speak truthfully Gov need to relook what they are doing People with EPF less than 20k saving. EPF full withdrawal I Sinar 20 Bantu rakyat dengan duit rakyat.

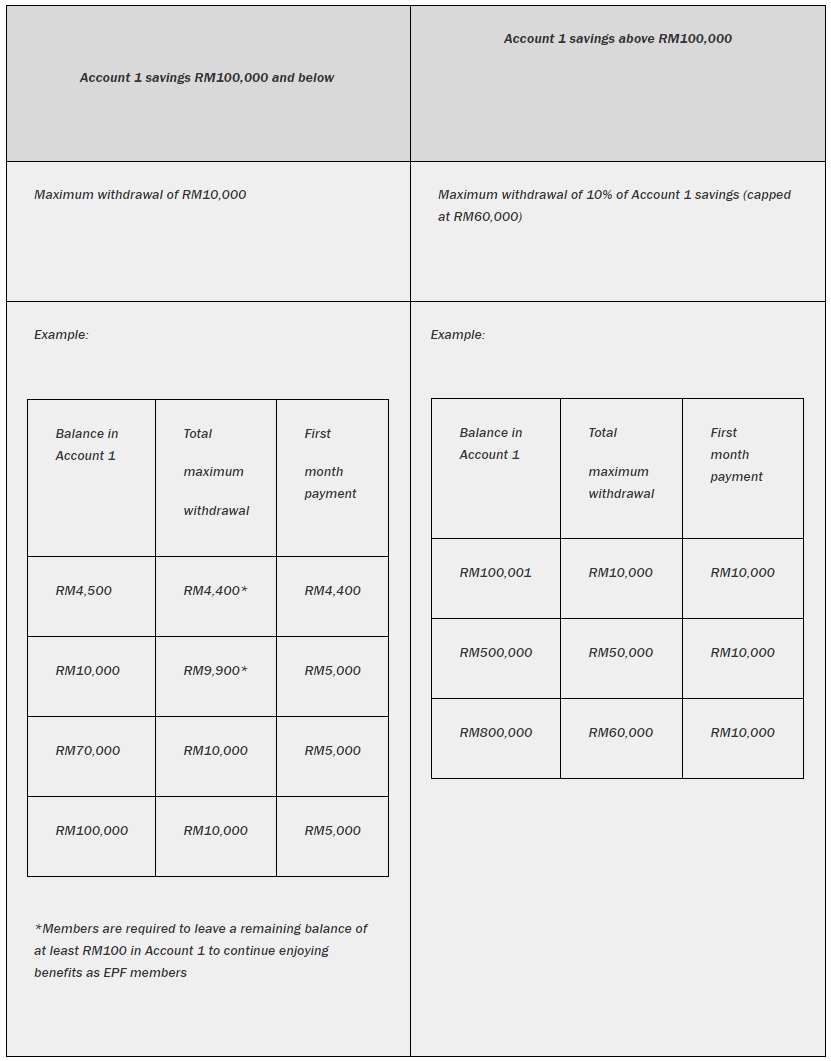

Mohd Shahar stated in Parliament on August 8 that this is in addition to the reduction in the employee share statutory contribution rate for 27 months from April 2020 to June 2022. Due to the Covid-19 crisis four withdrawal programmes were implemented. For those with they can withdraw any amount up to RM10000.

However the maximum total amount withdrawal allowed is RM60000. The four withdrawal programmes that took place due to the Covid-19 pandemic are i-Lestari i-Sinar i-Citra as well as the special one-off withdrawal of RM10000. For further information members may contact the i-Sinar hotline at 03-8922 4848.

The i-Sinar program was introduced to assist members who are affected by the current pandemic situation. KUALA LUMPUR Aug 8. The payments will be staggered over a period of six 6 months with the first payment of up to RM10000.

Affected members who wish to take out funds are able. In general the withdrawal will add liquidity to the countrys economy and this should give a boost to economic activities as Malaysians have a high tendency to spend Yesterday the EPF said it expects the i-Sinar facility to benefit two million eligible members with an estimated advance amount of RM14 billion to be made available. The deputy minister said that this worrying level of savings was exacerbated by the implementation of four Covid-19-related withdrawal facilities namely i-Lestari i-Sinar i-Citra and the RM10000 special withdrawalThis is on top of a reduced statutory contribution rate for members for a period of 27 months from April 2020 to June 2022.

It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. More than 8 million members will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar programme. This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19.

Payments will be staggered over a maximum period of. The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below. This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members.

However the amount withdrawn will be subject to the account balance. The level of savings of Employees Provident Fund EPF members is low and very worrying especially after the implementation of four withdrawal facilities which saw a RM145 billion withdrawn by members said Deputy Finance Minister I Datuk Mohd Shahar AbdullahThe four withdrawal programmes that took place due to the Covid-19. I-Lestari i-Sinar i-Citra and a unique one-time withdrawal of RM10000.

Show posts by this member only Post 1. 1 According to EPF this has resulted in 61 million members having less than RM 10000 currently in their savings and a staggering 79 of them having less than RM 1000 left consequently. Junior Member 38 posts Joined.

The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1. Jun 7 2021 1020 AM updated 2y ago. Let them withdraw all lah.

The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December. The idea is that this will help those who have been impacted by the prolonged pandemic to make ends meet.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar And I Citra Not Heavily Impacting Epf Investment At The Moment The Star

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar Category 2 How To Apply And Eligibility Comparehero

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Updated I Sinar Program Details Epf Members Can Start To Apply I Sinar Starting From 21 Dec 2020 News Puchong Co

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Applications Are Now Open For Category 1 Here S How To Apply

I Sinar 8 Other Things You Can Use Your Epf For

I Sinar A Rm56bil Question Mark The Star

Epf Announces Terms For I Sinar Withdrawal Japict

I Sinar 8 Other Things You Can Use Your Epf For

I Sinar The Pros And Cons Of Withdrawing Money From Your Epf Account Rojakdaily

Epf I Sinar Akaun 1 Advance Facility What You Need To Know

Bernama Epf Offers Further Details On I Sinar In Response To Media Query

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Comments

Post a Comment